- Design a BPMN process with multiple node types

- Create user-facing forms

- Integrate with external systems

- Handle branching logic based on business rules

- Send notifications

Time required: 30-45 minutesPrerequisites:

- Access to FlowX Designer

- A workspace and project set up (create one here)

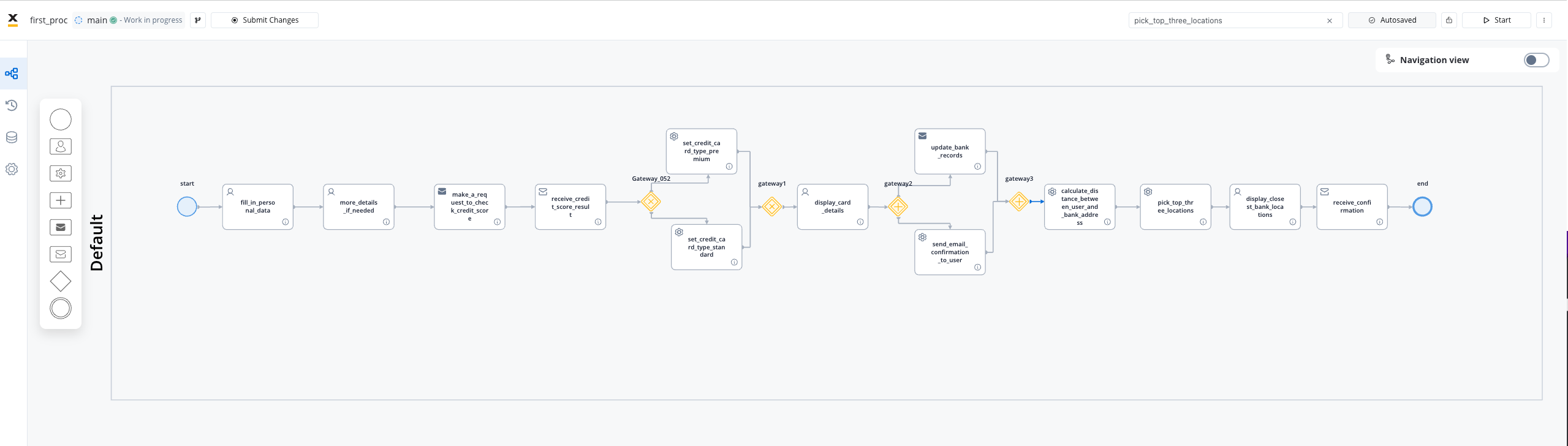

What you’ll build

A customer requests a new credit card through a bank app. The process:- Collects personal information

- Checks credit score automatically

- Assigns a card type based on the score

- Sends confirmation email

- Lets the user pick a branch for card pickup

Download this process

Import this BPMN file to follow along or explore the finished result.

Step 1: Create the process

Learn more about processes

Step 2: Collect user data (User Task)

The first step is collecting the customer’s personal information.Design the form

In the node settings, open the UI Designer. Add form fields:

- Full name (text input)

- Email (text input with email validation)

- Date of birth (date picker)

- Annual income (number input)

Learn more about User Tasks

Step 3: Check credit score (Service Task)

Now we’ll call an external credit scoring service automatically.Add a Send Message Task

This sends the customer data to your credit score adapter.Configure the Kafka topic to send to your credit scoring integration.

Learn more about integrations

Step 4: Branch based on credit score (Exclusive Gateway)

Different credit scores qualify for different card types.Configure branch conditions

- Branch 1:

application.creditScore >= 700→ Premium card - Branch 2:

application.creditScore >= 500→ Standard card - Branch 3: Default → Basic card

Learn more about Gateways

Step 5: Show results and confirm (User Task)

Let the customer review their card type and confirm.Step 6: Send notification and register (Parallel Gateway)

After confirmation, two things happen simultaneously:Branch 1: Send confirmation email

Add a Send Message Task that triggers the notification plugin.Configure email template with customer name and card type.

Branch 2: Register in bank system

Add a Send Message Task to your bank system adapter.This creates the card request in your core banking system.

Learn more about Notifications

Step 7: Select pickup location (User Task)

Let the customer choose where to pick up their card.Add a Service Task to fetch locations

Call an API (like Google Maps) to get nearby branches based on customer address.

Step 8: End the process

Add a Receive Message Task

This waits for confirmation that the customer picked up the card (from branch system).

Test your process

Start a process instance

Click Run to start a new instance. Fill in the forms and watch the process flow.

What you learned

You’ve built a complete process that demonstrates:| Concept | How you used it |

|---|---|

| User Tasks | Collecting data, showing confirmations |

| Service Tasks | Calling external APIs, setting data |

| Exclusive Gateway | Branching based on credit score |

| Parallel Gateway | Running email + registration simultaneously |

| Integrations | Credit score check, bank system, notifications |